Please refer to important disclosures at the end of this report

1

Supriya Lifescience Limited was incorporated in March 2008 by Satish

Waman Wagh. Company is one of the key Indian manufacturers and

suppliers of active pharmaceutical ingredients (APIs). Supriya Lifescience

Limited focus on research and development along with this company focus is

on diverse therapeutic areas and niche products. Company has niche product

offerings of 38 APIs focused on diverse therapeutic segments such as

antihistamine, analgesic, anaesthetic, vitamin, anti-asthmatic and anti-

allergic. Company export to 86 countries to 1296 customers including 346

distributors. Companies manufacturing plant located at Maharashtra, which

is spread across 23806 sq. mt.

Positives: (a) (a) Backward integration of API business, lead to better margins and

reduce dependency on import of raw material, 12 of existing products are

backward integrated which contributes 67.1% of revenue. (b) Export contributes to

77.5% of FY2021 revenue, company export to 86 countries like Latin America,

Europe, China and Cambodia etc. (c) Company has niche product offerings of 38

APIs focused on diverse therapeutic segments and company has filled have filed

14 active DMFs with USFDA and 8 active CEPs.

Investment concerns: (a) High customer concentration, Top-10 customers

contributes to 47% of H1FY22 revenue, any loss of a customer can be a risk. (b)

The company already has a high export market share in key APIs, it will be

changing for the company to increase its market share further. (c) In the last 3

years, companies’ gross margin and EBITDA margins have increased significantly,

it will be difficult for the company to improve margins from these levels.

Outlook & Valuation: Based on FY2021 numbers, the IPO is priced at an

EV/EBITDA of 11.2 times and price to earnings of 16.2 times at the upper price

band of the IPO. Supriya Lifescience Limited focuses on research & development

and having a diversified niche product portfolio of API’s. Companies 77.5% of

revenue comes from the Export market, companies’ key market are USA, Europe,

China and India. We believe that the company's new manufacturing unit and

product launch will be growth drivers for the company in future. Hence, we are

assigning a “SUBSCRIBE” recommendation to the Supriya Lifescience Limited IPO.

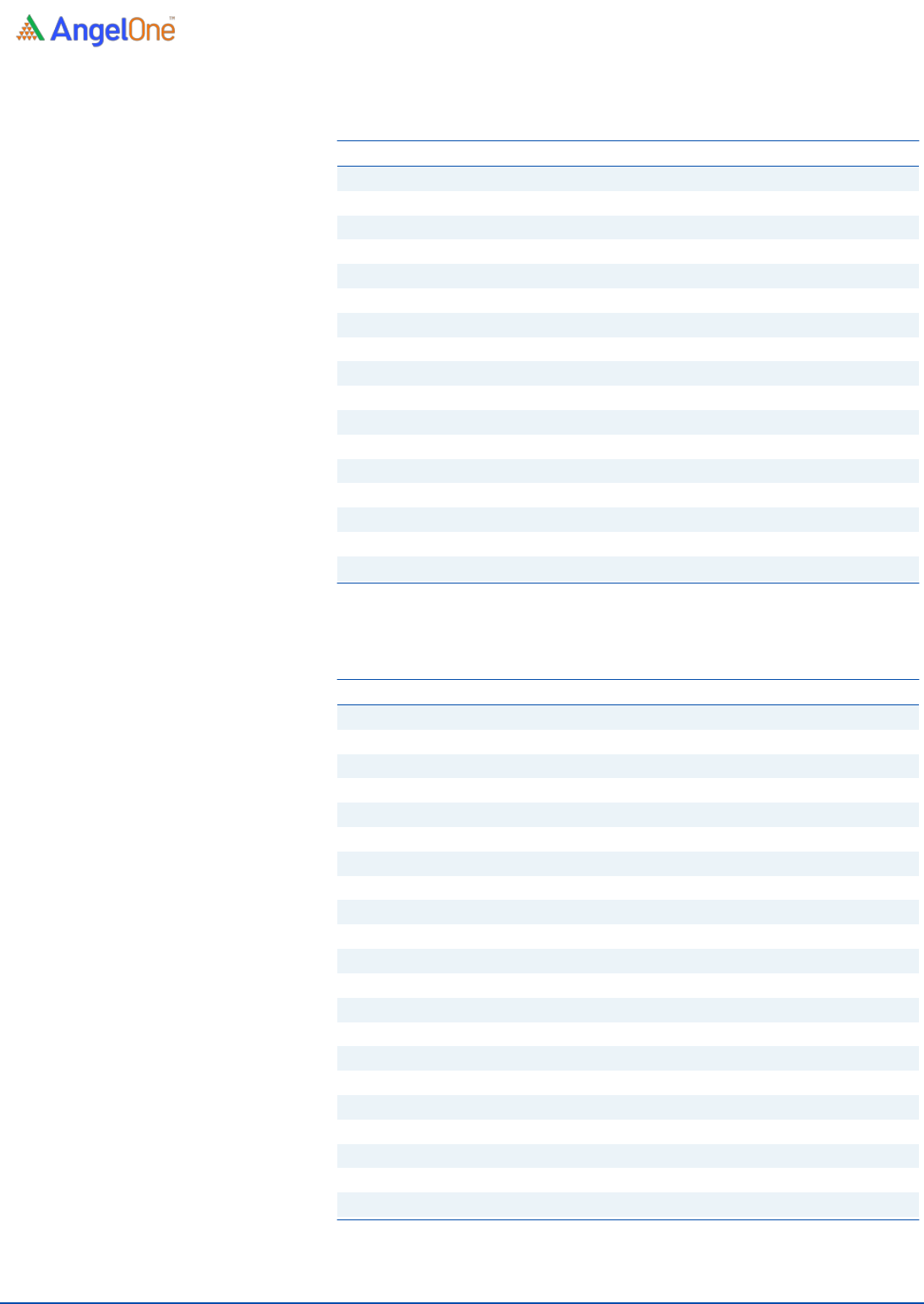

Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Net Sales

277.8

311.6

385.3

224.8

% chg

-

12

23.7

-

Net Profit

39.5

73

123.8

65.9

% chg

-

86

68.7

-

EBITDA (%)

26.2

35.1

46.2

43.9

EPS (as stated)

5.4

10.0

16.9

9.0

P/E (x)

50.9

27.3

16.2

15.2

P/BV (x)

21.3

13.4

7.4

6.0

EV/EBITDA

27.7

18.5

11.2

5.1

EV/Sales

7.3

6.5

5.2

2.2

Source: Company, Angel Research

SUBSCRIBE

Issue Open: Dec 16, 2021

Issue Close: Dec 20, 2021

Offer for Sale: `500 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 67.6%

Others 32.4%

Fresh issue: `200 cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: `14.64 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `16.09 cr

Issue size (amount): `700 cr

Price Band: 265 - ₹274

Lot Size: 54 shares and in multiple thereafter

Post-issue mkt. cap: * `2,139 cr - ** `2,205 cr

Promoters holding Pre-Issue: 99.26%

Promoters holding Post-Issue: 67.59%

*Calculated on lower price band

** Calculated on upper price band

Book Building

SUPRIYA LIFESCIENCE LIMITED

IPO NOTE

SUPRIYA LIFESCIENCE LIMITED

December 15, 2021

Supriya Lifescience Limited | IPO Note

December 15, 2021

2

Company background

Supriya Lifescience Limited was incorporated in March 2008 by Satish Waman

Wagh. Pre IPO promoter still holds 99.26% of the company. Company is one of

the key Indian manufacturers and suppliers of active pharmaceutical ingredients

(APIs) with focus on research and development along with this company focus is

on diverse therapeutic areas and niche products.

Company has niche product offerings of 38 APIs focused on diverse therapeutic

segments such as antihistamine, analgesic, anaesthetic, vitamin, anti-asthmatic

and anti-allergic.

Company’s products are registered with various international regulatory

authorities such as USFDA, EDQM, etc. As of now, company have filed 14 active

DMFs with USFDA and 8 active CEPs with EDQM, for their API products in

different therapeutic areas.

Company consistently been the largest exporter of Chlorpheniramine Maleate and

Ketamine Hydrochloride from India. They were among the largest exporters of

Salbutamol Sulphate contributing to 31% of the API exports from India in FY 2021

in volume terms. Export contributes to 77.47% of FY2021 revenues, Company

export to 86 countries to 1296 customers including 346 distributors.

Companies manufacturing plant located at Maharashtra, which is spread across

23,806 sq. mt. The company has 4 blocks of which 4th block recently commenced

in May 2021.

Issue details

The IPO is made up of offer for sale of ₹500 Cr by promoter and fresh issue of

`200 Cr, total issue size of ₹700 Cr

Pre & Post Shareholding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Promoter

4,74,58,070

99.26%

5,43,94,215

67.58%

Promoter Group

9,96,45,055

0.72%

2,55,62,085

0.65%

Public

13,08,323

0.02%

5,26,500

31.76%

Total

14,84,11,448

100.0%

8,04,82,800

100.0%

Source: Company, Angel Research

Supriya Lifescience Limited | IPO Note

December 15, 2021

3

Objectives of the Offer

Funding capital expenditure requirements of the company.

Repayment certain borrowings.

General Corporate Purposes.

Key Management Personnel

Satish Waman Wagh is the Promoter, Chairman and Managing Director of the

company. He has been a director on the Board since incorporation. Apart from his

association with the company, he is a director on the boards of Supriya Medi-

Chem Pvt Ltd, Lote Industries Testing Laboratory Association and Sachin

Industries Ltd.

Smita Satish Wagh is the Whole-time Director of the company. She has been a

director on the Board since incorporation. Apart from her association with the

company, she is a director on the boards of Supriya Medi-Chem Pvt Ltd.

Balasaheb Gulabrao Sawant is the Whole-time Director of the company. He was

previously associated with companies such as USV Ltd, Encure Pharmaceuticals

Ltd, Arch Pharmalabs Ltd, Mylan Laboratories Ltd and Enaltec Labs Pvt Ltd.

Kedar Shankar Karmarkar is the Independent Director of the company. He was

previously associated with Ciba-Geigy AG as a trainee and with the laboratory of

Institut Fur Organische Chemie Der Universitat Basel as a research fellow. He was

previously employed with Nicholas Piramal India Limited as an executive in the

R&D department.

Shireesh Bhalchandra Ambhaikar is the Chief Executive Officer of the company.

He joined the company on July 6, 2021.

Ashish Ramdas Nayak is the Chief Financial Officer of the company. He joined

the company on August 5, 2019.

Shweta Shivdhari Singh is the Company Secretary and Compliance Officer of the

company. She was appointed as the Company Secretary on August 26, 2019 and

was appointed as the Compliance Officer on May 6, 2021.

Supriya Lifescience Limited | IPO Note

December 15, 2021

4

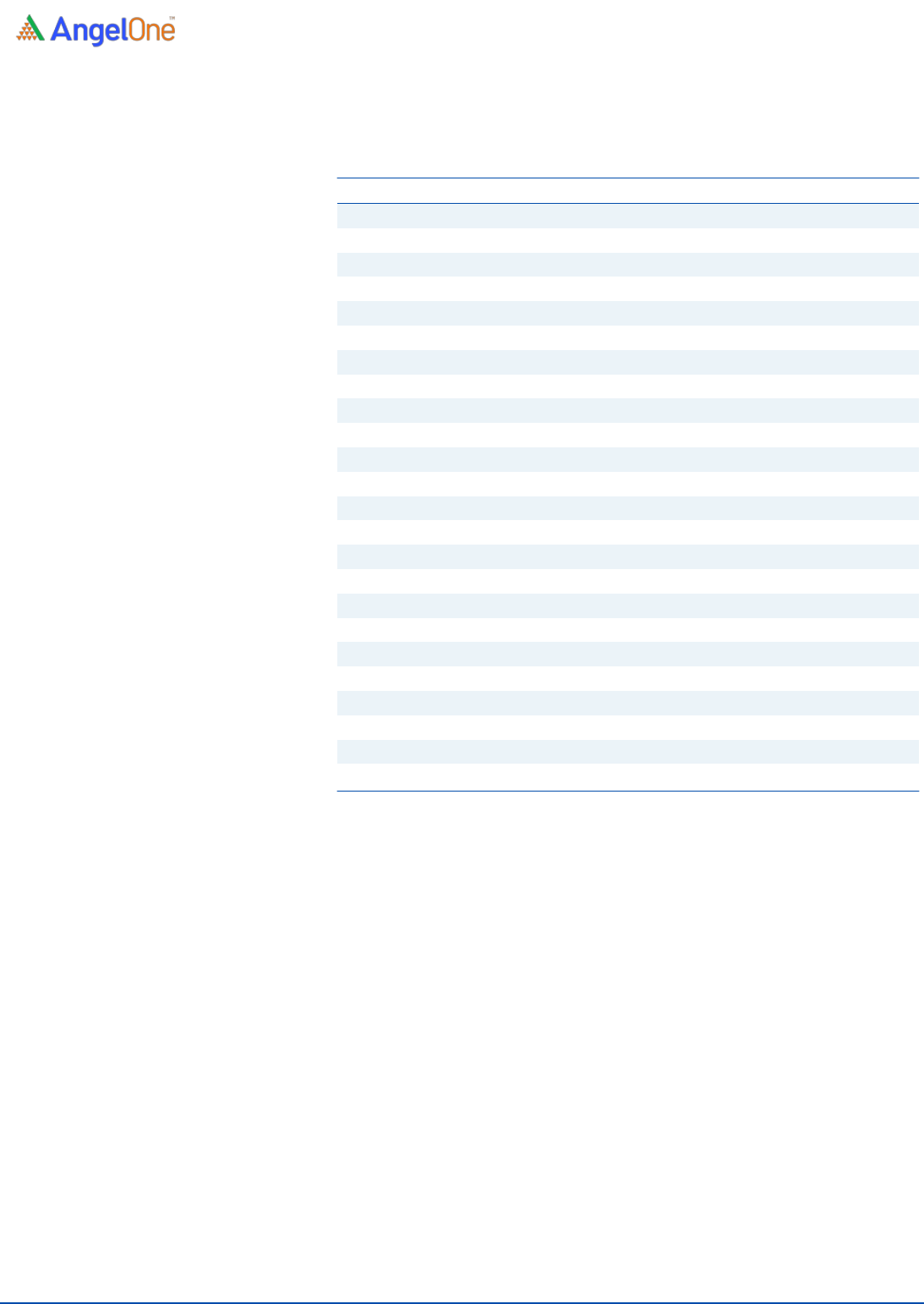

Exhibit 1: Consolidated Profit & Loss Account

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Total operating income

277.8

311.6

385.3

224.8

% chg

-

12

23.7

-

Total Expenditure

213

213

218

131

Raw Material

147

139

128

83

Employee Benefit Expense

19

26

33

18

Other Expenses

47

49

57

30

EBITDA

65

99

167

94

% chg

-

52

70

-

(% of Net Sales)

23.4

31.6

43.4

41.6

Depreciation & amortisation

5.4

6.3

6.6

4.9

EBIT

59.5

92.2

160.8

88.6

% chg

-

55

74

-

(% of Net Sales)

21.4

29.6

41.7

39.4

Interest & other Charges

10

7

4

2

Other Income

8.0

11.0

10.8

5.2

(% of Sales)

2.9

3.5

2.8

2.3

PBT

57.1

96.2

167.3

91.6

(% of Net Sales)

20.6

30.9

43.4

40.7

Tax

17.6

22.8

43.5

25.7

PAT (reported)

39.5

73.4

123.8

65.9

% chg

-

85.8

68.7

(% of Net Sales)

14.2

23.6

32.1

29.3

EPS (as stated)

5.39

10.0

16.9

9.0

% chg

-

86.2

68.7

Source: Company, Angel Research

Supriya Lifescience Limited | IPO Note

December 15, 2021

5

Exhibit 2: Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

SOURCES OF FUNDS

Equity Share Capital

14.6

14.6

14.6

14.6

Other equity

79

135

254

320

Shareholders Funds

94

149

269

335

Total Loans

24

31

29

14

Other liabities

0.7

1.0

1.3

2.2

Total Liabilities

118

181

300

351

APPLICATION OF FUNDS

Net Block

120

138

179

183

Current Assets

133

198

266

320

Sundry Debtors

60

52

74

84

Cash & Bank Balance

2

2

43

79

Other Assets

28

93

75

67

Current liabilities

135

155

146

153

Net Current Assets

-2

43

120

167

Other Non Current Asset

0.1

0.2

0.5

0.5

Total Assets

118

181

300

351

Source: Company, Angel Research

Supriya Lifescience Limited | IPO Note

December 15, 2021

6

Exhibit 3: Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Restated Profit before tax

57.1

96.2

167.3

91.6

Depreciation

5.4

6.3

6.6

4.9

Change in Working Capital

(17.2)

(1.5)

(44.5)

(26.5)

Interest Expense

9.9

6.8

4.0

2.0

Direct Tax Paid

(14.0)

(27.0)

(29.9)

(18.3)

Others

6.9

3.8

(1.4)

(1.1)

Cash Flow from Operations

48.6

116.0

79.9

15.8

(Inc.)/ Dec. in Fixed Assets

4.8

(24.5)

(47.4)

(9.6)

Cash Flow from Investing

4.8

(24.5)

(47.4)

(9.6)

Proceeds from Long Term Borrowing

(27.1)

(5.7)

(2.3)

-

Proceeds from Short Term Borrowing

(13.3)

(1.8)

(9.6)

0.9

Interest paid

0.0

(9.2)

(4.0)

1.1

Others

-

(17.6)

(3.9)

-

Cash Flow from Financing

(49.6)

(29.1)

(14.7)

1.8

Inc./(Dec.) in Cash

3.7

62.3

17.5

8.0

Opening Cash balances

8.6

12.3

74.7

92.2

Closing Cash balances

12.3

74.7

92.2

100.2

Source: Company, Angel Research

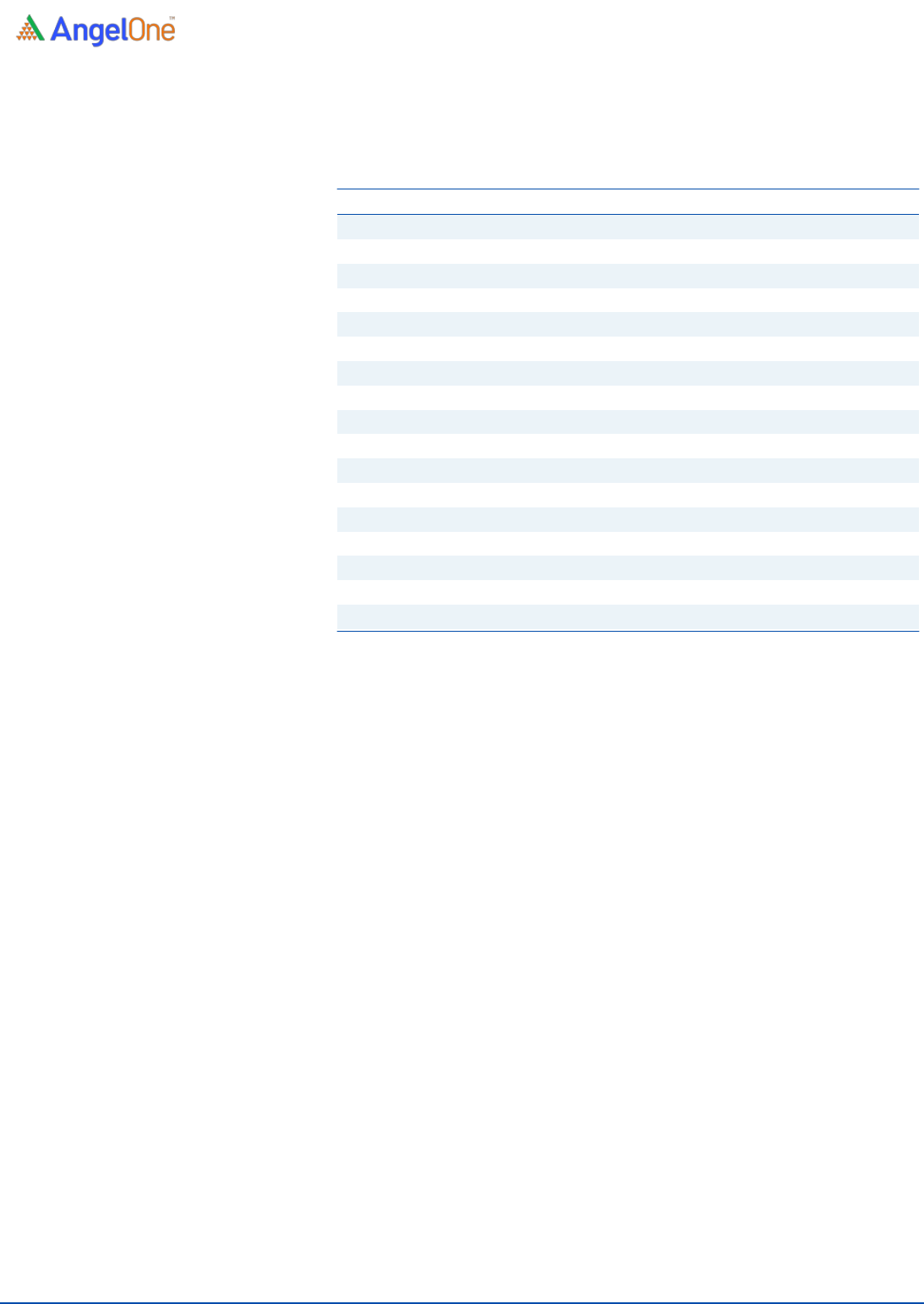

Exhibit 4: Key Ratios

Y/E March

FY19

FY20

FY21

H1FY22

Valuation Ratio (x)

P/E (on FDEPS)

50.9

27.3

16.2

15.2

P/CEPS

44.0

25.8

15.3

13.3

P/BV

21.3

13.4

7.4

6.0

EV/Sales

7.3

6.5

5.2

4.5

EV/EBITDA

27.7

18.5

11.2

10.2

Per Share Data (₹)

EPS (fully diluted )

5.39

10.03

16.92

9.01

Cash EPS

6.2

10.6

17.9

10.3

Book Value

12.8

20.4

36.8

45.9

DPS

-

-

-

Number of share

7.30

7.30

7.30

7.30

Returns (%)

RONW

42%

49%

46%

39%

ROCE

57%

57%

57%

53%

Turnover ratios (x)

Asset Turnover (net)

3.3

3.2

3.9

3.0

Receivables (days)

78.7

61.4

69.8

68.4

Inventory Days

14.4

23.2

33.2

33.7

Payables (days)

75.6

84.4

85.4

78.0

Working capital cycle (days)

17.5

0.1

17.6

24.1

Source: Company, Angel Research

Supriya Lifescience Limited | IPO Note

December 15, 2021

7

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing

in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the

report or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market

making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the

subject company. Research analyst has not served as an officer, director or employee of the subject company.